Deterministic Execution Environment

Proprietary low-latency infrastructure directly co-located with liquidity venues.

Engineered for deterministic execution in high-volatility regimes.

// DEFINITION: Boltzmann-Wigner Entropy Extraction.

We harvest volatility from the inefficiencies of human biological latency.

Total Return (Inception)

Benchmark Delta: +312%

Sharpe Ratio

Risk-Adj: SUPERIOR

Max Drawdown

Protection: ACTIVE

30D Notional Vol

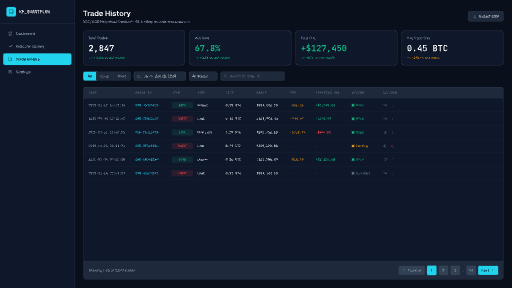

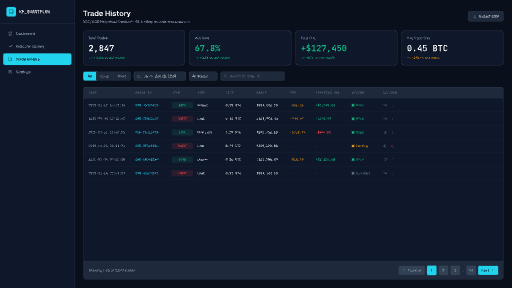

Trades: 142,091

*Public allocation is currently closed.

Proprietary low-latency infrastructure directly co-located with liquidity venues.

Engineered for deterministic execution in high-volatility regimes.

Markets are not random; they are the sum of human inefficiencies.

0xBW removes the human element entirely. We treat global liquidity as a physics problem—

calculating velocity, mass, and kinetic energy to extract signal where others only see noise.

Capturing the invisible momentum behind every candle.

Where others see price, we see energy vectors waiting to be harvested.

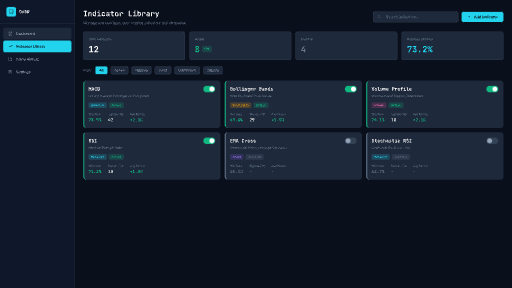

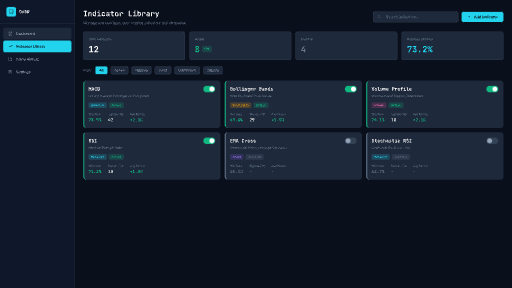

BrainWave scans millions of data points per second, identifying kinetic divergence patterns invisible to traditional analysis.

Every trade passes through 47 risk checkpoints. Position sizing is mathematically optimized for maximum Sharpe ratio.

Sub-millisecond order routing to multiple venues. Smart order splitting minimizes market impact and slippage.

For qualified institutional investors and family offices.